This report on the findings of an examination is here presented for informational purposes only and is not to be construed as legal opinion or advice. The reader is advised to consult a competent legal professional in connection with the use of its contents..

The borrower is strongly advised to consult his/her loan servicer for any adverse findings that may be discovered in an examination of his/her loan modification agreement.

The Home Affordable Modification Agreement that is the subject of this examination was among the documents that were presented for chain of title examination on May 3, 2023. This report and the accompanying Amortization Spreadsheet were prepared on May 16, 2023.

SUMMARY

1. The subject loan was granted by Great American Mortgage Corp. on March 9, 2006 for

$268,000.00. The promissory note was not presented in the chain of title examination. The

term and interest rate are unknown.

2. The loan was modified with JP Morgan Chase Bank, NA effective August 1, 2013 for

$344,280.45 for 480 months with interest fixed at 4.000% p.a.

3.The lender has charged the borrowers twice for interest for the period July 1 to 31, 2013

which amounted to $1,147.60; first, by compounding it with the new principal balance as of

August 1, 2013 and again, by making it a part of the first installment that was due also on

August 1, 2013.

4. There was a gap of more than seven years between the granting of the original loan and

the loan modification, yet the balance of the modified loan represents an increase of

$76,280.45 or 28% over the original loan.

The balance of the loan prior to the modification is not stated in the agreement. It is

understood that the increase represents interest and other amounts capitalized as of

August 1, 2013.

A detailed accounting of the unpaid and deferred interest, fees, escrow advances and other

costs that were added to the loan balance in order to arrive at the modified loan balance

was not part of or attached to this agreement.

5. The total amount that the borrowers will have to pay under the modification agreement is

$692,662.42.40 or 201% of the modified principal balance. This is not disclosed in the

agreement.

6. The agreement contains a provision that signifies that this loan transaction does not

partake of the nature of a new loan or a refinancing which is believed to be the basis for

the lender for not furnishing the borrowers a disclosure statement under the Truth-in-

Lending Act.

No explanation was found as to why a loan transaction that is not a refinance and which

only involves a reduction in annual percentage rate does not fall within the scope of the

purpose of the law which is to “promote the informed use of consumer credit by requiring

disclosures about its terms and cost.”

The findings in this examination are not included in the Summary of Findings.

MAIN REPORT

Premises

The subject loan was granted on March 9, 2006 by Great American Mortgage Corp. for $268,000.00. The promissory note was not presented in the chain of title examination. The original term and maturity date and interest rate are unknown.

The borrowers entered into a Loan Modification Agreement with JP Morgan Chase Bank, NA that took effect on August 1, 2013. The modified amount is $344,280.45 and the term is 480 months. The maturity date is July 1, 2053. The modified amount is levied interest at 4.000% p.a. for the entire term of the agreement. Monthly payment for principal and interest is $14,438.88.

The mortgaged property is in Staten Island, New York. This agreement was recorded in Richmond County on May 27, 2015.

It could not be ascertained if the promissory note has been endorsed. The Mortgage has been assigned six times. The sixth assignment shows that the Mortgage is now owned by Legacy Mortgage Asset Trust 2020-GS5 with US Bank, NA as Owner Trustee.

Basic Features

The parts of the agreement that contain provisions relevant to this audit are reproduced below.

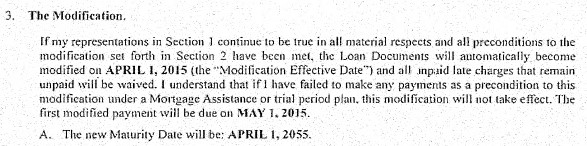

Section 1 of the agreement states that the modification effectivity date is August 1, 2013. The Unpaid Principal Balance is $344,280.45. This includes unpaid amounts loaned to the borrower plus any interest and other amounts capitalized.

Section 2 states that the Unpaid Principal Balance is levied interest at 4.00% p.a. from July 1, 2013 and that the first monthly payment of $1,438.88 was due on August 1, 2013. The maturity date is July 1, 2053 (which means that the term is 480 months).

Examiner’s Comments

Double-Charging of Interest

1. The First Instance

1.1. The Amount Charged

Section 1 of the agreement states that the new principal balance includes unpaid

amounts loaned to the borrower plus any interest and other amounts capitalized. The

new principal balance of $344,280.45 as of August 1, 2013 therefore includes interest

for the month of July, 2013.

Any unpaid interest that has been added to or compounded with the principal always

includes the interest for the month immediately prior to the compounding. This is

because payment for any arrears is applied first, to fees and/or costs and then to past

due interest and last, to past due principal. As for interest, payment is first applied to

the earliest period or month/s wherein interest is unpaid thereby leaving the interest for

the latter month/s still unpaid if the payment is not sufficient to cover all unpaid

interest. Thus, if any unpaid interest will be added to the principal, this interest will

always include that of the month immediately prior to the compounding. In this case,

that month is July, 2013.

Section 2 of the agreement states that interest at 4.00% p.a. will begin to accrue on

the new principal balance as of July 1, 2013.

Thus, the amount of $344,280.45 is the sum of (a) the balance of the loan before the

interest for July, 2013 was added to it, plus (b) the interest for July, 2013 which is

4.00% p.a. (0.3333% for one month; 0.003333 in decimal terms) of the balance before

the addition.

The above computation shows that the amount of $1,143.79 as unpaid interest for the

month of July, 2013 was added to the loan balance of $343,136.66 in order to arrive at

the balance as of August 1, 2013 of $344,280.45 (This computation assumes that the

balance of $343,136.66 already includes any other interest and other amounts

capitalized).

1.2. The Date of Charging

The first instance of double-charging occurred on the effectivity date of the agreement

when the interest for the month of July, 2013 was added to the principal. The

agreement states that its effectivity date is August 1, 2013. It was signed by the

borrowers on July 17, 2013 and by the lender’s representative on July 29, 2013.

1.3. The Date of Payment

By including all amounts and arrearages in the new principal balance, the status of the

loan is updated to “current”. The unpaid interest as of August 1, 2013 is now

considered paid, but instead of the borrowers’ cash being depleted, their debt is

increased. This arrangement was initiated by the lender.

2. The Second Instance

2.1. The Amount Charged

Interest in the amount of $1,147.60 is the product of multiplying $344,280.45, the

amount of modified principal, by 4.00% (or 0.040), the rate of interest per annum and

dividing the result by 12 months. This amount is affirmed by the lender through the

Amortization Spreadsheet, as demonstrated below:

(This spreadsheet was prepared using the amounts specified by the lender in the

agreement. The application of these amounts carries the implication that the payments

will be made by the borrowers as scheduled in the agreement.)

a. The amount of monthly installment of $1,438.88 as specified in the agreement,

includes the interest of $1,147.60 for the first month as computed above, leaving

$291.28 to reduce the principal. The payment of $291.28 is then deducted from

$344,280.45, the previous balance of the modified principal, leaving an end-of-first

month balance of $343,989.17 (see Amortization Spreadsheet, Month No. 1).

b. In the second month, the same amount of monthly installment of $1,438.88 includes

the interest of $1,146.63 for the second month ($343,989.17 multiplied by 0.040,

divided by 12), leaving $292.25 to reduce the principal. The payment of $292.25 is

then deducted from $343,989.17, the balance from the first month, leaving an end-

of-second month balance of $343,696.92 (See Amortization Spreadsheet, Month

No. 2).

c. The same procedure in paragraphs 2.a. and 2.b. is repeated from Month No. 3 until

the end of the term of the agreement.

d. Finally, the affirmation by the lender of the amount of $1,147.60 comes at the end of

the amortization spreadsheet wherein, after the repeated application of the

procedures of computation stated in this paragraph on the amounts specified by the

lender in the agreement, the loan will be fully paid. There will be a rounding-off

difference of +$0.52 (see Amortization Spreadsheet, Month No. 480).

The proof of the affirmation is that the loan will be fully paid as computed using the

amounts specified by the lender. There would not have been such affirmation had

this computation resulted in a negative balance (overpayment). Thus, the lender

really intended to include the interest for the month of July, 2013 in the August 1,

2013 installment.

2.2. The Date Charged

The Amortization Spreadsheet is based on the dates and amounts stated in the

agreement. Thus, the effectivity date stated in Paragraph 1.2. also applies.

2.3. The Date of Payment

The second payment occurred when the borrower paid the first monthly installment.

This installment is assumed to have been paid unless the lender can show proof that

its non-payment is one of the causes of its current collection efforts and/or action to

foreclose.

3. Conclusion

In the first instance of interest charging, interest for the month of July, 2013 in the amount

of $1,143.79 was added by the lender to the loan balance in order to arrive at the modified

balance of $344,280.45 as of August 1, 2013. This interest is considered paid by the

borrowers on August 1, 2013 when it was made part of the modified loan balance.

In the second instance of interest charging, the lender made the interest for August, 2013

amounting to $1,147.60 part of the first installment that was due on August 1, 2013.

Payment occurred when the borrower paid the first monthly installment. The first

installment is assumed to have been paid because almost three years have passed since it

became due and the loan is still current.

In loan modifications, unpaid interest as of the effectivity date of the modification

agreement is added to the principal in order to arrive at the modified balance. This will

include the interest for the month immediately preceding the effectivity date. A double-

charging of interest occurs when the first monthly payment is made to fall due on

modification effectivity date. The interest double-charged will also be for the month

immediately preceding the effectivity date of the agreement.

This double-charging can therefore be avoided by moving the due date of the first payment

one month after effectivity date. In doing so, the interest component of the first payment

would be the interest covering the month starting from the date of loan modification or loan

granting up to the day immediately before the due date of the first payment. This is the

usual practice for new loans and in some loan modifications and reflects the fact that the

lenders and servicers knew how to avoid double-charging their borrowers.

Comparison

The features of the first modified loan are herein compared with those of the original loan.

Examiner’s Comments

There was a gap of more than seven years between the granting of the original loan and the loan modification, yet the balance of the modified loan represents an increase of $76,280.45 or 28% over the original loan.

The balance of the loan prior to the modification is not stated in the agreement. It is understood that the increase represents interest and other amounts capitalized as of August 1, 2013.

A detailed accounting of the unpaid and deferred interest, fees, escrow advances and other costs that were added to the loan balance in order to arrive at the modified loan balance was not part of or attached to this agreement.

Payments

The total amount that the borrowers will have to pay under the modification agreement is computed as follows.

Examiner’s Comments

The total amount that the borrowers will have to pay under the modification agreement is $692,662.42.40 or 201% of the modified principal balance. This is not disclosed in the agreement.

See Amortization Spreadsheet.

Disclosure

The following provision signifies that this loan transaction does not partake of the nature of a new loan or a refinancing which is believed to be the basis for the lender for not furnishing the borrowers a disclosure under the Truth-in-Lending Act.

12 CFR § 226.20 on Subsequent Disclosure Requirements states that “a refinancing occurs when an existing obligation is satisfied and is replaced by a new obligation undertaken by the same consumer. A refinancing is a new transaction requiring new disclosures to the consumer” and that “a reduction in the annual percentage rate with a corresponding change in the payment schedule” “shall not be treated as a refinancing” (abridged).

On the other hand, 12 CFR § 226.1 states that “the purpose of this regulation is to promote the informed use of consumer credit by requiring disclosures about its terms and cost.”

Examiner’s Comments

No explanation was found as to why a loan transaction that is not a refinance and which only involves a reduction in annual percentage rate does not fall within the purpose of the scope of the law which is “to promote the informed use of consumer credit by requiring disclosures about its terms and cost.”

Some borrowers who are more familiar with ways of institutionalized lending would not need as much effort and assistance as others would in order to be fully informed of the costs of their respective uses of credit. In other words, the need to be furnished such quality of credit information as would inform a borrower about the terms and cost of his/her credit depends on the borrower. The need to be fully informed is not dictated by the type of credit, or whether a loan transaction is a refinance or a modification.

Moreover, the lack of disclosure could have left the borrowers unaware that (a) the balance of the loan modification is 28% higher than the balance of the original loan despite the gap of more than seven years between the granting of the original loan and the loan modification, and (b) the total amount that they will have to pay on the loan under the loan modification agreement is 201% of the modified balance.

AMORTIZATION SPREADSHEET

Monthly amortizations based on the agreement are shown in detail in a spreadsheet. The amounts do not include payments intended for the escrow account. Selected pages of the spreadsheet are shown in the following pages for the purpose of explanation. A complete copy is attached to the printed report.

Line 1 shows the start of monthly amortizations in equal amounts to be applied to interest based on the diminishing balance of the principal and the principal. The interest rate and amount of monthly installments for the entire term of 480 months are 4.000% p.a. and $1,438.88.

The first payment that became due on August 1, 2013 covered (a) interest for the period July 1 to 31, 2013, based on the balance of $344,280.45 at 4.000% p.a.; and (b) a reduction of the balance of $344,280.45 by the remainder of $1,438.88 minus (a).

Page 1 shows that, assuming the monthly installments have been paid as scheduled, after the 30th payment, of the monthly installments totaling $43,166.40, $33,992.25 or 78.75% has been applied to interest and $9,174.15 has reduced the balance by 2.66%.

Page 2 shows that, assuming the monthly installments have been paid as scheduled, after the 60th payment, of the monthly installments totaling $86,332.80, $67,021.33 or 77.63% has been applied to interest and $19,311.47 has reduced the balance by 5.61%.

Page 3 shows that, assuming the monthly installments have been paid as scheduled, after the 90th payment, of the monthly installments totaling $129,499.20, $98,986.13 or 76.44% has been applied to interest and $30,513.47 has reduced the balance by 8.86%.

Line 118 above shows that, assuming the monthly installments have been paid as scheduled, as of May 1, 2023, the loan had a balance of $302,253.92. As of this date, interest has been paid up to April 30, 2023.

Page 4 shows that, assuming the monthly installments have been or will be paid as scheduled, after the 120th payment, of the monthly installments totaling $172,665.60, $129,774.90 or 75.16% has been or will be applied to interest and $42,890.70 will reduce the balance by 12.46%.

Page 8 shows that, assuming the monthly installments have been or will be paid as scheduled, after the 240th payment, of the monthly installments totaling $345,331.20, $238,497.64 or 69.06% has been or will be applied to interest and $106,833.56 will reduce the balance by 31.03%.

Page 12 shows that, assuming the monthly installments have been or will be paid as scheduled, after the 360th payment, of the monthly installments totaling $517,996.80, $315,835.13 or 60.97% has been or will be applied to interest and $202,161.67 will reduce the balance by 58.72%.

Page 16 shows that, assuming the monthly installments have been or will be paid as scheduled, after the 480th payment on July 1, 2053, the maturity date, of the monthly installments totaling $690,662.40, $346,382.47 or 50.15% has been or will be applied to interest and $344,279.93 will fully pay the loan. There will be a rounding-off difference of +$0.52.

End of article.

Case No. >