This report on the findings of an examination is here presented for informational purposes only and is not to be construed as legal opinion or advice. The reader is advised to consult a competent legal professional in connection with the use of its contents.

The borrower is strongly advised to consult his/her loan servicer for any adverse findings that may be discovered in an examination of his/her loan modification agreement.

The Home Affordable Modification Agreement that is the subject of this examination was among the documents that were presented for securitization audit on February 21, 2023. This report and the accompanying Amortization Spreadsheet were prepared on May 8, 2023.

SUMMARY

1. The loan that was granted on February 7, 2006 for $539,000 payable in 360 months with

an adjustable interest rate starting at 7.750% p.a. for the first 12 months was modified

effective April 1, 2015 for $622,136.69 payable in 480 months. A graduated rate of interest

starting at 2.000% p.a. for the first 60 months was levied on the balance of $436,267.55.

$185,869.14 of the modified balance was treated as a non-interest-bearing “Deferred

Balance.”

2. There was a gap of more than nine years between the granting of the original loan and the

date of modification, yet the modified principal balance represents an increase of

$83,136.69 or 15% of the original loan.

The agreement states that the amount payable under the note is $622,136.69. This

includes deferred and unpaid interest, fees, escrow advances and other costs but

excluding unpaid late charges and other charges not permitted under the terms of the

HAMP modification.

A detailed accounting of the items that are referred to as deferred and unpaid interest,

fees, escrow advances and other costs was not a part of or attached to the agreement.

3. The total amount that the borrower will have to pay on the loan over the entire term of the

agreement is $989,954.10 or 159% of the modified principal balance. This is not stated in

the agreement. This includes the amount of $185,869.14 (30%) in balloon payment for the

deferred principal balance.

4. The agreement contains a provision that signifies that this loan transaction does not

partake of the nature of a new loan or a refinancing which is believed to be the basis for

the lender for not furnishing the borrower a disclosure statement under the Truth in-

Lending Act (Regulation Z).

No explanation was found as to why a loan transaction that is not a refinance and which

only involves a reduction in annual percentage rate does not fall within the scope of the

purpose of the law which is to “promote the informed use of consumer credit by requiring

disclosures about its terms and cost.”

The findings in this examination are not included in the Summary of Findings.

MAIN REPORT

Premises

The subject loan was granted on February 7, 2006 by All-American Home Mortgage Corp. for $539,000. The term was 360 months with an adjustable interest rate starting at 7.750% p.a. for the first 12 months.

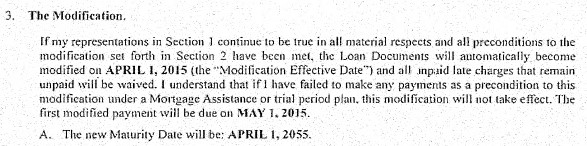

The borrower entered into a Home Affordable Modification Agreement with HSBC Bank USA, NA as Trustee for Deutsche Alt-A Securities, Inc. Mortgage Pass-Through Certificates Series 2007-AR3 that took effect on April 1, 2015. The modified amount was $622,136.69 and the term was 480 months to mature on April 1, 2055. $185,869.14 was deferred (the “Deferred Balance”) leaving a balance of $436,267.55 as the Interest-Bearing Balance.

Interest was levied on the Interest-Bearing Balance starting at 2.000% p.a. from April 1, 2015, 3.000% p.a. from April 1, 2020 and 3.875% p.a. from April 1, 2021 onwards.

Monthly payments for principal and interest were $1,321.13 from May 1, 2015, $1,534.85 from May 1, 2020 and $1,731.37 from May 1, 2021 onwards.

A final payment of an unspecified amount was due as the last payment to be applied to the loan balance on maturity date. This is understood to be the “Deferred Balance” of $185,869.14.

The mortgaged property is in Staten Island NY. The Mortgage was recorded in Richmond County on February 21, 2006.

The note has not been endorsed but the Mortgage has been assigned three times. The last assignee is HSBC Bank USA, NA as Trustee for Deutsche Alt-A Securities, Inc. Mortgage Loan Trust Series 2007-AR3.

Basic Features

The parts of the agreement that contain provisions relevant to this audit are reproduced below.

Section 3 of the agreement states that its effectivity date is April 1, 2015 and that the first modified payment will be due on May 1, 2015.

Section 3B states that the New Principal Balance is $622,136.69. This includes deferred and unpaid interest, fees, escrow advances and other costs but excluding unpaid late charges and other charges not permitted under the terms of the HAMP modification.

Section 3C states that $185,869.14 of th new principal balance shall be deferred and will be non-interest-bearing. The interest-bearing principal balance is $436,267.55. Interest at 2.00% will begin to accrue on this balance on April 1, 2015. The first monthly payment is due on May 1, 2015.

Section 3C lays out the schedule of payments as follows:

Examiner’s Comments

Double-Charging of Interest

There is no double charging of interest in this loan modification. The effectivity date of the agreement was April 1, 2015 and the due date of the first monthly payment was May 1, 2015.

Comparison

The features of the modified loan are herein compared with those of the original loan.

Examiner’s Comments

There was a gap of more than nine years between the granting of the original loan and the date of modification, yet the modified principal balance represents an increase of $83,136.69 or 15% of the original loan.

The agreement states that the amount payable under the note is $622,136.69. This includes deferred and unpaid interest, fees, escrow advances and other costs but excluding unpaid late charges and other charges not permitted under the terms of the HAMP modification.

A detailed accounting of the items that are referred to as deferred and unpaid interest, fees, escrow advances and other costs was not a part of or attached to the agreement.

Payments

The total amount that the borrower will have to pay under the modification agreement is computed as follows.

Examiner’s Comments

The total amount that the borrower will have to pay on the loan over the entire term of the agreement is $989,954.10 or 159% of the modified principal balance. This is not stated in the agreement. This includes the amount of $185,869.14 (30%) in balloon payment for the deferred principal balance.

See Amortization Spreadsheet

Disclosure

The following provision signifies that this loan transaction does not partake of the nature of a new loan or a refinancing which is believed to be the basis for the lender for not furnishing the borrower a disclosure under the Truth-in-Lending Act.

12 CFR § 226.20 on Subsequent Disclosure Requirements states that “a refinancing occurs when an existing obligation is satisfied and is replaced by a new obligation undertaken by the same consumer. A refinancing is a new transaction requiring new disclosures to the consumer” and that “a reduction in the annual percentage rate with a corresponding change in the payment schedule” “shall not be treated as a refinancing” (abridged).

On the other hand, 12 CFR § 226.1 states that “the purpose of this regulation is to promote the informed use of consumer credit by requiring disclosures about its terms and cost.”

Examiner’s Comments

No explanation was found as to why a loan transaction that is not a refinance and which only involves a reduction in annual percentage rate does not fall within the purpose of the scope of the law which is “to promote the informed use of consumer credit by requiring disclosures about its terms and cost.”

Some borrowers who are more familiar with ways of institutionalized lending would not need as much effort and assistance as others would in order to be fully informed of the costs of their respective uses of credit. In other words, the need to be furnished such quality of credit information as would inform a borrower about the terms and cost of his/her credit depends on the borrower. The need to be fully informed is not dictated by the type of credit, or whether a loan transaction is a refinance or a modification.

Moreover, the lack of disclosure could have left the borrower unaware that (a) the modified principal balance represents an increase of 15% of the original loan despite the gap of more than nine years between the granting of the original loan and the date of modification and (b) the total amount that he will have to pay on the loan is $989,954.10 or 159% of the modified principal balance. This includes the amount of $185,869.14 (30%) in balloon payment for the deferred principal balance.

AMORTIZATION SPREADSHEET

Monthly amortizations based on the agreement are shown in detail in a spreadsheet. The amounts do not include payments intended for the escrow account. Selected pages of the spreadsheet for the purpose of explanation are shown in the following pages. A complete copy is attached to the printable report.

Line 1 shows the start of monthly amortizations in equal amounts applied to the principal and interest based on diminishing balances. The interest rate and monthly installments for the first 60 months are 2.000% p.a. and $1,321.13.

The first payment that became due on May 1, 2015 covered (a) interest for the period April 1 to 30, 2015 based on the interest-bearing balance of $436,267.55 at 2.000% p.a.; and (b) a reduction of the interest-bearing balance of $436,267.55 by the remainder of $1,321.13 less (a).

Page 1 shows that, assuming that monthly installments have been paid as scheduled, after the 30TH payment, of the monthly installments totaling $39,633.90, $21,375.94 or 53.93% has been applied to interest while $18,257.96 has reduced the interest-bearing balance by 2.93%.

Page 2 shows that, assuming that monthly installments have been paid as scheduled, after the 60TH payment, of the monthly installments totaling $79,267.80, $41,816.57 or 52.75% has been applied to interest while $37,451.23 has reduced the interest-bearing balance by 6.02%.

Line 61 shows the start of monthly amortizations from the 61ST to the 72ND month. Interest rate and amount of monthly payment are 3.000% p.a. and $1,534.85.

Line 73 shows the start of monthly amortizations from the 73RD month onwards. Interest rate and amount of monthly payment are 3.875% p.a. and $1,731.37.

Page 3 also shows that, assuming that monthly installments have been paid as scheduled, after the 90TH payment, of the monthly installments totaling $128,850.66, $76,258.89 or 59.18% has been applied to interest while $52,591.77 has reduced the interest-bearing balance by 8.45%.

Line 94 shows that, assuming that monthly installments have been paid as scheduled, the loan had an interest-bearing balance of $381,696.55 after applying the installment due for February 1, 2023. As of this date, interest has been paid up to January 31, 2023.

Page 4 also shows that, assuming that monthly installments have been paid as scheduled, after the 120TH payment, of the monthly installments totaling $180,791.76, $112,714.48 or 62.34% has been or will be applied to interest while $68,077.28 will reduce the interest-bearing balance by 10.94%.

Page 8 shows that, assuming that monthly installments have been paid as scheduled, after the 240TH payment, of the monthly installments totaling $388,556.16, $241,131.51 or 62.06% has been or will be applied to interest while $147,424.65 will reduce the interest-bearing balance by 23.70%.

Page 12 shows that, assuming that monthly installments have been paid as scheduled, after the 360TH payment, of the monthly installments totaling $596,320.56, $332,066.95 or 55.69% has been or will be applied to interest while $264,253.61 will reduce the interest-bearing balance by 42.48%.

Page 16 shows that, assuming the monthly installments have been or will be paid as scheduled, after the 480TH payment on April 1, 2055, the maturity date, of the monthly installments totaling $804,084.96, $367,815.49 or 45.74% have been or will be applied to interest and $436,269.47 will fully pay the interest-bearing balance. The non-interest-bearing deferred balance of $185,869.14 will require a balloon payment in order to fully pay off the loan, There will be a rounding-off difference of -$1.92.

End of article.

No comments:

Post a Comment